Expense tracking

Last updated February 25, 2025

Expense tracking is essential for notaries to maintain financial health, maximize tax deductions, and ensure compliance with business regulations. By recording costs like travel, supplies, and marketing, notaries can accurately assess profitability, streamline tax filing, and make informed decisions about their business.

Feature

Expenses View

The Expenses view gives you a clean, sortable table to track individual transactions. You can:

- Sort by Date, Amount, Vendor, Category, or Receipt status

- Filter expenses by custom date ranges

- Export to CSV for use by your bookkeeper in outside tools like QuickBooks

- Instantly see missing receipts or vendors, making reconciliation easy

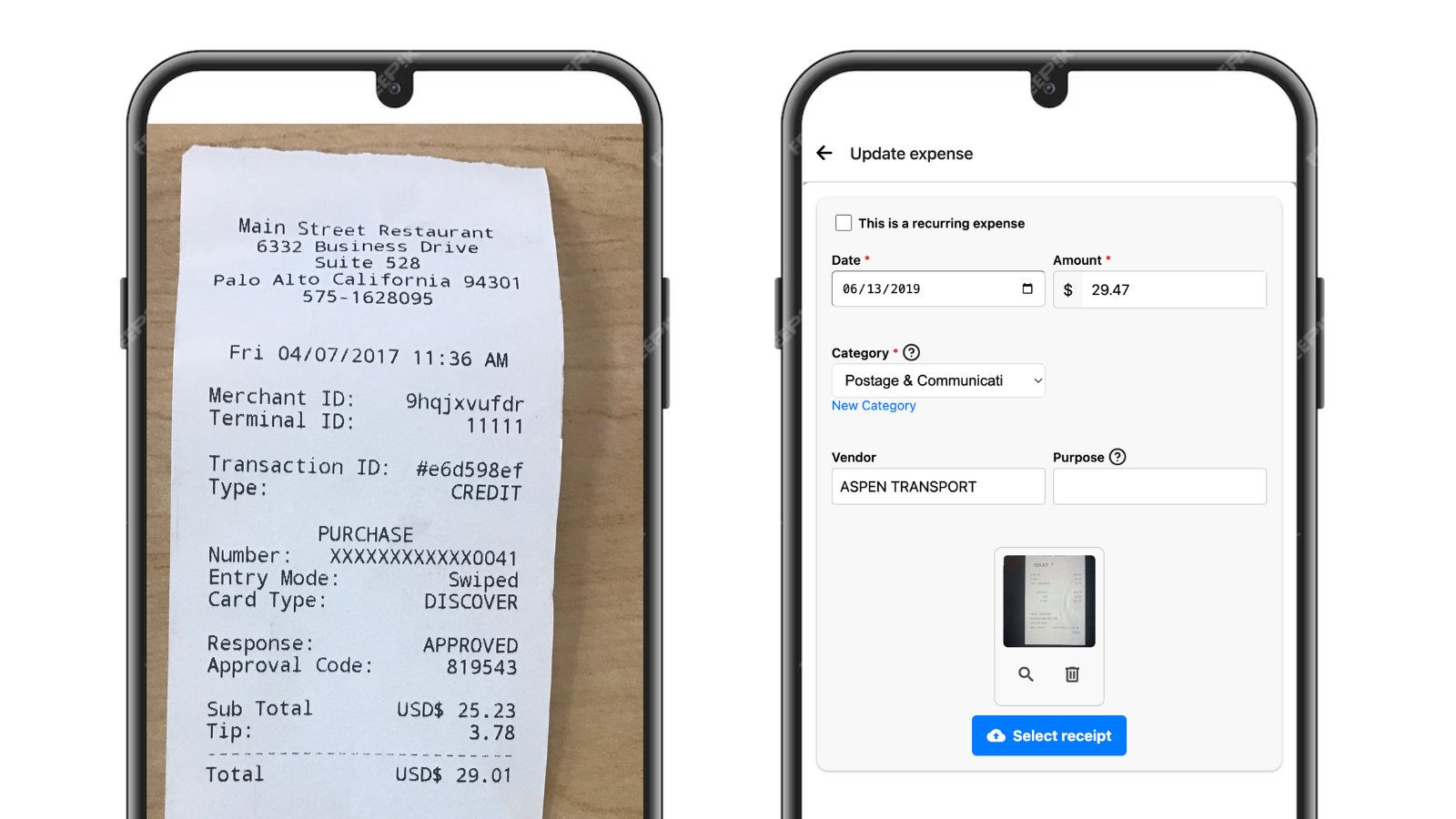

Smart Expense Capture

Creating new expenses is quick and mobile-friendly:

- Snap a photo of your receipt — the app will automatically extract details like amount, date, vendor, and even auto-categorize the expense

- Supports both one-time and recurring expenses, perfect for regular costs like subscriptions

- Reduces manual entry and saves time, especially when you're on the go

How does Notary Central's expense tracking compare to other options?

| NotaryCentral | Notary-specific apps (NotaryGadget) | Quickbooks | |

|---|---|---|---|

| Receipt capture with just a picture | ✅ | 🚫 | ✅ |

| Easily visualize which expenses are missing receipts | ✅ | 🚫 | ✅ |

| Tie expenses to specific notary appointments to understand the real profit per appointment | ✅ | ✅ | 🚫 |

| Generate expense reports that are easy to share with accountants | ✅ | ✅ | ✅ |

Works On These Devices

Mobile

Tablet

Desktop